For Immediate Release

MENLO PARK – California’s renters tax credit would be updated to help low-income households, especially those with children, under a broadly supported bipartisan bill introduced by Senator Steve Glazer and coauthored by Senator Josh Becker.

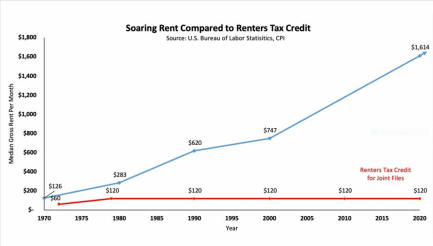

In all, 43 state legislators are backing Senate Bill 843 to increase and restructure California’s Renters Tax Credit, which was last updated in 1979 and currently provides just $60 in tax credits for single renters and $120 for renting couples. SB 843 would provide income-eligible California households with a renters tax credit of $500 for single residents and $1,000 for single parents and couples.

Senator Becker, D-Peninsula, said today:

“California renters are caught between the soaring costs to keep a roof over their heads and the scarcity of affordable housing. No one feels the squeeze as much as low-income families. They often have no options but to pay rising rents.

“This legislation would increase the renters tax credit for those who need it most.

“Overall in my district, renters account for 44% of households — but that average hides the need you can see when you look at communities individually. In East Palo Alto, renters make up much as 60% of all households, illustrating the importance of restructuring the renters tax credit.

“This change is more than 40 years overdue.

“I’m proud to support this legislation as a coauthor.”

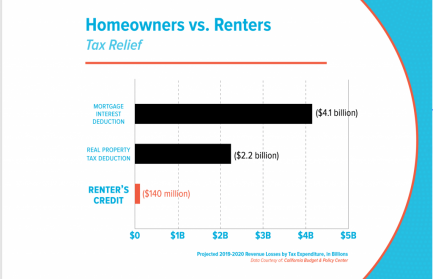

For more background on SB 843, the text of the bill is here, and Senator Glazer’s news release on the bill is here. The California’s Renters Tax Credit has lagged far behind the relentless surge of rent increases, and renters receive far less of a tax break than homeowners, as graphics shared by Senator Glazer show:

Media Contact: Leslie Guevarra, leslie.guevarra@sen.ca.gov, 415-298-3404